Creating A Home Repair Emergency Fund

You may already have enough in savings-just make it more accessible

Any unexpected large home repair is bad enough; but combine that with having no way to pay for repairs or temporary shelter and you have the ultimate home disaster. A home emergency fund can help to save you from financial discomfort or worse. Even if you believe your house is in great shape, you never know when you’ll have to deal with a surprise repair.

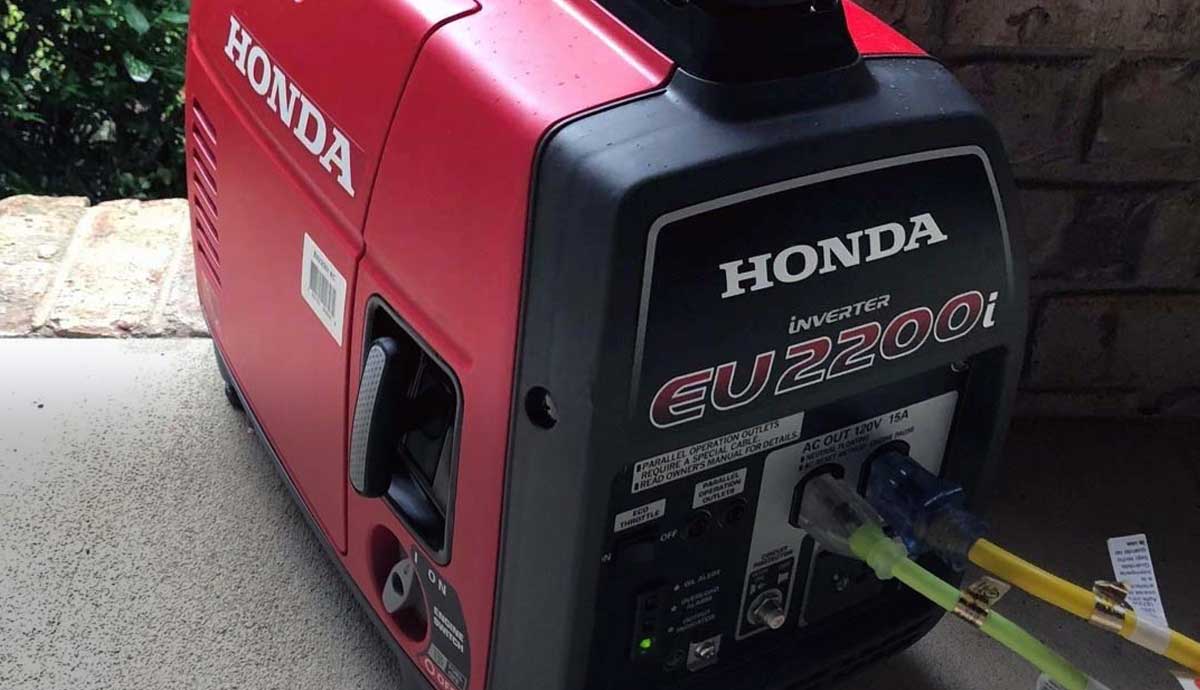

Even if you diligently perform recommended preventive maintenance tasks and follow all the rules for making proactive replacements, you may not be able to protect yourself from an unexpected catastrophe. Our poor friends in Texas this year, with no power, frozen pipes and flooding will attest to that. But you can still be prepared by having an emergency repair fund handy.

What’s a home repair emergency fund?

A home repair emergency fund is money set aside to pay for unexpected, emergency-type home repairs. These repairs are considered normal but not predictable. I am not talking about natural disasters, wars, riots or alien invasions, but having an emergency fund can help with any of those also.

An emergency repair fund should consist of money available in a readily liquid form. Not cash, but a checking account with access to funds. You don’t want to have the money in a long-term savings portfolio where you’ll face massive fees if you pull money out early.

Homeowners don’t need to get too creative with an home repair emergency fund. A simple savings or money market account will suffice so long as it is separate from your normal checking account and thus less visible and tempting. The most important thing is the money must be there when you need it. A useful option is to have access to cash through a debit card or a pre-approved line of credit. Credit cards can work as a temporary resource also, but you will be faced with huge fees and interest rates if you don’t pay it completely off when due.

Even if you believe your house is in great shape, you never know when you’ll have to deal with a surprise repair.

How much money should you save in your emergency fund?

Some financial advisors suggest that homeowners create a cash reserve of three to six months of living expenses. Others recommend you have a cash reserve target of about 1% to 3% of your home value. So, if your home is worth $500,000, this suggests setting aside $5,000 to $15,000.

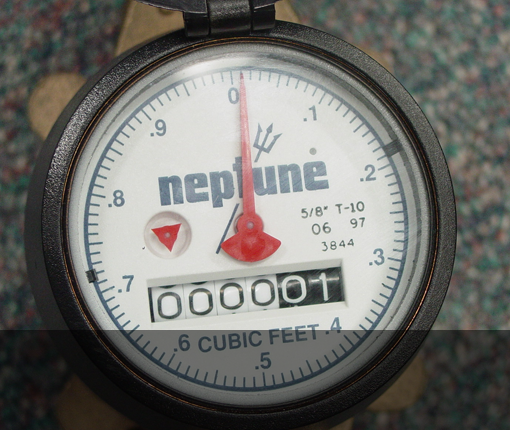

A good way to check if you’ve saved enough is to learn what items are most likely to fail in your home, then allow for the highest possible cost to repair/replace them. Some examples of the most likely items to fail are: Emergency water heater replacement $2500-$5,000; burst pipe water damage $10,000-$100,000; hot water re-circulator pumps $600-$800; septic systems $5,000-$10,000; gutter replacement $2500-$5,000; downspouts $600-$1200; drainage system failures $4,000-$8,000; sump pump replacement $500-$1,000; dishwasher flooding and replacement $1200-$5,000; spoiled refrigerator/freezer food $400-$800; down tree removal $3,000-$8,000. Some of these numbers are staggering.

Of course, each situation is different. A new home with all new systems and appliances is less likely to tap into a home repair emergency fund for many years. Fixer-uppers and older homes, of course, will probably require that money sooner. Larger homes should have a larger fund than a smaller home.

Some financial advisors suggest that homeowners create a cash reserve of three to six months of living expenses. Others recommend you have a cash reserve target of about 1% to 3% of your home value.

General emergency funds

In addition to a home repair emergency fund, it’s also wise to create two general emergency funds: an everyday emergency fund and a disaster fund. Everyday emergencies—such as a worn out dishwasher in your home—can cut into your monthly budget, so having some cash stowed away will allow you to still pay your rent or mortgage. Work toward having about 10% of your annual wage in your everyday emergency savings account tor if you’re self-employed, put aside 20% since the income is likely to be more variable.

The second emergency fund—the disaster fund—is for life’s calamities that interrupt your income. It could be suffering a natural disaster, losing your job, falling ill and/or needing to take time off work, dealing with a death in the family.

The concern is when something catastrophic happens that people could risk losing their home because all suddenly they can’t make their mortgage payment.

Work toward saving 20% of your mortgage balance for the dire emergency fund. If you put aside money automatically from each check and you’ll quickly begin to get closer to your goal. For instance, putting aside $25 every week will get you $1,300 in a year.

“Put aside” means to have a savings account where the money is readily available through checks or a cash card. Use a savings or money market account for your emergency fund. Something that is safe, low risk and easily accessible when needed.

What if you have too small an emergency fund

Let’s say your septic system dies in the middle of summer and you desperately need to replace it, but you don’t have a home repair emergency fund. Where do you turn? Two options are a home equity loan and a home equity line of credit, or HELOC.

Both of these solutions let you tap into the value of your home to cover emergency costs. A major difference is that the home equity loan is a lump sum and you often have a fixed interest rate. Equity loans take longer to approve and longer to fund and thus may be unacceptable for an emergency situation.

HELOC is a line of credit that you can borrow. These are usually set up in advance and the homeowner can draw on the money quickly and at any time. A HELOC lets you draw money from the account as much as you need up to the available maximum amount. Also, a HELOC usually has an adjustable interest rate.

In a worst-case situation, without some emergency amount saved, a credit card may have to do.